Quantitative Tools for Decision Making: Making Informed Choices

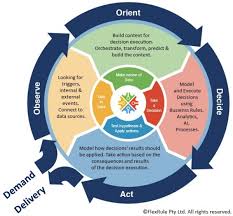

In today’s fast-paced and data-driven world, decision making has become an increasingly complex task. From businesses to individuals, making the right choices is crucial for success and achieving desired outcomes. To aid in this process, quantitative tools have emerged as valuable resources for making informed decisions based on objective analysis and data-driven insights.

Quantitative tools encompass a range of techniques that help individuals and organizations analyze numerical data to evaluate options, assess risks, and optimize outcomes. These tools provide a systematic approach to decision making by transforming complex information into manageable insights. Let’s explore some of the most commonly used quantitative tools:

- Decision Trees: A decision tree is a graphical representation of different possible outcomes and the associated probabilities. It helps visualize the decision-making process by considering various alternatives and their potential consequences. Decision trees assist in identifying the most favorable path based on calculated probabilities, enabling individuals or organizations to make well-informed choices.

- Cost-Benefit Analysis: Cost-benefit analysis (CBA) is a technique used to evaluate the financial feasibility of a project or decision. It involves quantifying both the costs and benefits associated with different alternatives and comparing them to determine which option offers the greatest net benefit. CBA provides a structured framework for assessing economic viability while considering both tangible and intangible factors.

- Monte Carlo Simulation: Monte Carlo simulation is a powerful tool that uses random sampling techniques to model uncertainty in decision making. By generating multiple simulations based on known probabilities, it helps estimate potential outcomes under different scenarios. This tool enables decision makers to understand the range of possibilities, assess risks, and make more informed choices.

- Linear Programming: Linear programming is an optimization technique used when there are constraints on resources or objectives need to be maximized or minimized within those limitations. It involves formulating mathematical models that represent real-world problems with linear relationships between variables. By solving these models, decision makers can identify the optimal solution that maximizes efficiency and minimizes costs.

- Sensitivity Analysis: Sensitivity analysis is a technique used to assess the impact of changes in variables or assumptions on the outcomes of a decision. It helps decision makers understand how sensitive their decisions are to different factors and identify critical variables that significantly influence the results. By conducting sensitivity analysis, individuals or organizations can make more robust decisions that account for various uncertainties.

These quantitative tools provide valuable insights into complex decision-making scenarios, helping individuals and organizations make better choices based on objective analysis rather than subjective judgment alone. However, it’s important to note that these tools should not be seen as standalone solutions but as aids in the decision-making process. They require input from domain experts and thoughtful interpretation to derive meaningful conclusions.

In conclusion, quantitative tools for decision making offer a systematic approach to analyzing data, evaluating alternatives, and optimizing outcomes. By leveraging these tools effectively, individuals and organizations can enhance their decision-making processes, minimize risks, and maximize opportunities. Whether it’s in business or personal life, embracing quantitative tools empowers us to make informed choices that lead to success and desired results.

Frequently Asked Questions: Quantitative Tools for Decision Making

- What are the quantitative tools?

- What are the qualitative tools for decision-making?

- What are quantitative decision techniques?

- How is quantitative data used in decision-making?

What are the quantitative tools?

Quantitative tools are techniques and methods used to analyze numerical data and make informed decisions based on objective analysis. These tools help individuals and organizations evaluate options, assess risks, and optimize outcomes. Here are some commonly used quantitative tools:

- Decision Trees: Decision trees are graphical representations that map out different possible outcomes and their associated probabilities. They assist in visualizing the decision-making process by considering various alternatives and their potential consequences.

- Cost-Benefit Analysis: Cost-benefit analysis (CBA) is a technique used to evaluate the financial feasibility of a project or decision. It involves quantifying both the costs and benefits associated with different alternatives and comparing them to determine which option offers the greatest net benefit.

- Monte Carlo Simulation: Monte Carlo simulation is a tool that uses random sampling techniques to model uncertainty in decision making. It generates multiple simulations based on known probabilities, helping estimate potential outcomes under different scenarios.

- Linear Programming: Linear programming is an optimization technique used when there are constraints on resources or objectives need to be maximized or minimized within those limitations. It involves formulating mathematical models that represent real-world problems with linear relationships between variables.

- Sensitivity Analysis: Sensitivity analysis is a technique used to assess the impact of changes in variables or assumptions on the outcomes of a decision. It helps understand how sensitive decisions are to different factors and identify critical variables that significantly influence the results.

These quantitative tools provide structured frameworks for analyzing data, evaluating alternatives, and making informed choices based on objective analysis rather than subjective judgment alone. They enable decision makers to consider various factors, assess risks, and optimize outcomes for better decision making in diverse contexts such as business, finance, engineering, healthcare, and more.

What are the qualitative tools for decision-making?

Qualitative Tools for Decision Making: Insights Beyond Numbers

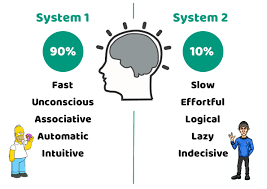

While quantitative tools provide valuable insights through numerical analysis, decision making often requires considering qualitative factors that cannot be easily quantified. Qualitative tools help decision makers understand the subjective aspects, opinions, and perceptions surrounding a decision. These tools allow for a more holistic approach to decision making by incorporating non-numeric information. Let’s explore some commonly used qualitative tools:

- SWOT Analysis: SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a widely used tool that helps assess the internal and external factors influencing a decision or situation. It involves identifying and evaluating the strengths and weaknesses of an organization or individual, as well as the opportunities and threats present in their environment. SWOT analysis provides a framework for understanding the broader context in which decisions are made.

- PESTLE Analysis: PESTLE (Political, Economic, Social, Technological, Legal, Environmental) analysis is a tool that examines external factors impacting an organization or project. It helps identify relevant political, economic, social, technological, legal, and environmental influences that may affect the decision-making process. By considering these factors, decision makers gain a broader understanding of the potential opportunities and challenges associated with their choices.

- Decision Matrix: A decision matrix is a systematic tool used to evaluate alternatives against multiple criteria or factors. It involves creating a table where each alternative is assessed based on different qualitative criteria using subjective judgments or ratings. Decision matrices help structure complex decisions by providing a visual representation of trade-offs between different options.

- Mind Mapping: Mind mapping is a technique that visually organizes thoughts and ideas around a central concept or problem statement. It allows individuals to explore various perspectives and connections related to the decision at hand. By visually mapping out ideas and relationships between them, mind mapping helps stimulate creativity and generate new insights during the decision-making process.

- Focus Groups: Focus groups involve gathering a small group of individuals who represent the target audience or stakeholders and conducting facilitated discussions to gather qualitative insights. This tool helps decision makers understand opinions, preferences, and perceptions related to a particular decision or product. Focus groups provide valuable qualitative data that can inform decision-making processes.

- Expert Opinions: Seeking expert opinions is another qualitative tool that decision makers can leverage. Experts in a specific field or domain provide valuable insights based on their knowledge and experience. Their perspectives can help decision makers gain a deeper understanding of the implications and potential outcomes associated with different choices.

It’s important to note that qualitative tools often involve subjective interpretations and rely on human judgment. They complement quantitative tools by providing a more comprehensive understanding of the context, emotions, and human factors involved in decision making.

In conclusion, qualitative tools play a crucial role in decision making by considering non-numeric information, subjective factors, and the broader context surrounding choices. By incorporating these tools into the decision-making process, individuals and organizations can gain deeper insights, consider diverse perspectives, and make more informed decisions that align with their goals and values.

What are quantitative decision techniques?

Quantitative decision techniques refer to a set of methods and approaches that utilize numerical data and mathematical models to support decision-making processes. These techniques aim to provide objective and quantitative insights into complex problems, enabling individuals or organizations to make informed choices based on data-driven analysis. Some common quantitative decision techniques include:

- Decision Trees: Decision trees are graphical representations that help visualize different decision paths and potential outcomes. By assigning probabilities and values to each branch, decision trees assist in identifying the most favorable course of action based on calculated probabilities.

- Cost-Benefit Analysis: Cost-benefit analysis (CBA) is a technique used to evaluate the financial feasibility of a project or decision. It involves quantifying both the costs and benefits associated with different alternatives and comparing them to determine which option offers the greatest net benefit.

- Linear Programming: Linear programming is an optimization technique used when there are constraints on resources or objectives need to be maximized or minimized within those limitations. It involves formulating mathematical models that represent real-world problems with linear relationships between variables, allowing decision makers to identify the optimal solution.

- Monte Carlo Simulation: Monte Carlo simulation is a powerful tool that uses random sampling techniques to model uncertainty in decision making. By generating multiple simulations based on known probabilities, it helps estimate potential outcomes under different scenarios, enabling decision makers to assess risks and make more informed choices.

- Sensitivity Analysis: Sensitivity analysis examines how changes in variables or assumptions impact the outcomes of a decision or model. It helps identify critical factors that significantly influence results, allowing decision makers to understand the robustness of their decisions in the face of uncertainties.

- Statistical Analysis: Statistical analysis involves applying statistical methods to analyze data sets and draw meaningful conclusions. Techniques such as regression analysis, hypothesis testing, and correlation analysis help identify patterns, relationships, and trends in data that can inform decision making.

These quantitative decision techniques provide structured frameworks for analyzing complex problems, evaluating alternatives, and optimizing outcomes. By leveraging these techniques, decision makers can make more informed choices based on objective analysis, reducing the reliance on subjective judgment alone. However, it’s important to note that these techniques should be used in conjunction with domain expertise and careful interpretation of results to derive meaningful insights and make effective decisions.

How is quantitative data used in decision-making?

Quantitative data plays a crucial role in decision-making by providing objective and measurable information that can be analyzed and interpreted to inform choices. Here are some key ways in which quantitative data is used in decision-making:

- Identifying patterns and trends: Quantitative data allows decision makers to identify patterns and trends by analyzing numerical information over time or across different variables. This analysis helps in understanding the relationships between different factors, spotting emerging patterns, and making predictions about future outcomes.

- Assessing risks and uncertainties: Quantitative data enables decision makers to assess risks associated with different options or scenarios. By analyzing historical data or conducting probability assessments, decision makers can quantify the likelihood of specific outcomes, estimate potential losses or gains, and make informed decisions based on risk tolerance.

- Comparing alternatives: Quantitative data provides a basis for comparing different alternatives objectively. By quantifying relevant factors such as costs, benefits, performance metrics, or customer preferences, decision makers can evaluate options side by side and determine which one offers the best value or aligns most closely with their objectives.

- Supporting cost-benefit analysis: Quantitative data is instrumental in conducting cost-benefit analysis (CBA). CBA involves quantifying both the costs and benefits associated with a decision or project. By assigning monetary values to various factors and comparing them, decision makers can assess the financial feasibility of options and prioritize investments based on their potential returns.

- Optimizing resource allocation: Quantitative data helps optimize resource allocation by identifying areas of inefficiency or opportunities for improvement. By analyzing data on resource utilization, productivity metrics, demand patterns, or market dynamics, decision makers can allocate resources effectively to maximize efficiency, minimize costs, and achieve desired outcomes.

- Monitoring performance: Quantitative data allows decision makers to monitor performance against predefined targets or benchmarks. By tracking key performance indicators (KPIs) over time using quantitative metrics, organizations can identify areas where they are falling short, make data-driven adjustments, and improve overall performance.

- Supporting forecasting and planning: Quantitative data is essential for forecasting future trends, demand patterns, or market conditions. By analyzing historical data and using statistical models, decision makers can make informed predictions about future scenarios, enabling them to plan ahead, allocate resources effectively, and anticipate potential challenges or opportunities.

It’s important to note that while quantitative data provides valuable insights, it should be complemented with qualitative information and expert judgment. Decision-making often requires a combination of both quantitative and qualitative analysis to account for factors that may not be easily quantifiable. By leveraging the power of quantitative data alongside other sources of information, decision makers can make more informed choices that are grounded in evidence and analysis.